Are you starting a new business in the virtual environment? Then we need to talk about commercial add-ons for online stores. When you start an online store, you have to set up both the design and the brand book, as well as your company’s positioning. But then, you also need to think about promoting it. Above all, you must focus on setting up the financial part – the area that often determines whether a business will be successful or problematic.

Let’s not forget that pricing policies online differ from those offline. For example, some costs related to storage and displaying goods are reduced. However, expenses on digital promotion and distribution tend to increase. You’ll also need to invest in research into your competitors and target audience. We recommend that you establish a digital marketing budget from the outset, as it can significantly influence the profit margin, particularly during the first year of operation.

Since the cost structure in the online environment differs from offline operations, this article will help you establish some basic KPIs for your online store: the right trade markup, profit margin, and net profit.

Commercial Allowance Calculations for Online Stores

The commercial allowance represents the difference between the selling price of a product and its purchase cost. The higher you set the commercial allowance, the easier it will be for you to grow your business and stay financially healthy.

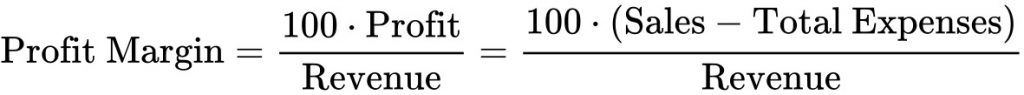

The profit margin indicates, in percentage terms, how profitable your company is. It is calculated as the net selling price minus the direct costs of producing and delivering the product to the customer.

Net profit is calculated as total sales minus all costs, including duties, interest, and taxes. It is typically calculated annually to give you a clear picture of the business’s financial health after all taxes and debts have been paid.

Net profit = Pre-tax profit − tax

When considering offering discounts, remember that the discount should be less than the profit margin, not the trade markup. Incorrectly setting discounts is one of the most common mistakes new entrepreneurs make, which can lead to operating at a loss. And this might not be noticed until it’s too late.

How to Increase the Profitability of Your Online Store?

To boost profitability online, think about whether you can offer a different range of products. Can you modify or expand your product line so that you offer something unique in the market? Next, consider adding value to your products through additional content or services. As the digital environment is fast-paced, dynamic, and highly competitive, making your products more interactive and attractive is key to keeping up with consumer demands.

Good luck with your business, and we wish you the highest possible net profit!